Faster Tax Intake with an AI-Powered Client Tax Organizer

Client tax organizers should simplify tax season, but most end up creating even more work — endless follow-ups, mismatched uploads, and hours spent sorting files.

An AI-powered organizer like Soraban Collect cuts out that manual effort by handling intake tasks automatically, giving your team a clean, complete starting point so they can focus on real tax work instead of tracking down documents.

Why traditional client tax organizers create more work than they solve

Many firms still rely on static PDFs or generic portals that push the work back onto staff. Clients often send the wrong files, forget requests, or stop responding entirely, leaving your team spending hours chasing documents instead of preparing returns.

The hidden costs of manual document collection

Admins and preparers track missing W-2s through emails and texts, rename generic or unorganized files to match client records, and manually match uploads to the correct client. Clients may forget what was requested, submit incorrect files, or go silent.

These repetitive tasks can consume 20+ hours weekly during peak busy season. Meanwhile, preparers sit idle when a single missing 1099 blocks an entire return. During peak season, work piles up while staff act as document detectives instead of completing returns.

How the "open item circle of doom" kills profitability

When a project is deemed ready for the preparer, they get straight to work entering data, making decisions, and using their expertise. But when they come across a document that is missing, the project grinds to a halt.

Now, this is likely something that was beyond what an admin’s experience could realistically catch while managing hundreds of projects. However, it still puts the project back a step or two into the “open items”, where the preparer has to send repeated reminders, deadlines slip, and the same cycle repeats across dozens of clients.

This relentless back-and-forth drains peak season productivity, erodes profits, and wears down team morale.

What AI-powered client tax organizers actually do

Clients log in through any way they choose, including secure password-free, see exactly what's still needed, and track their progress in real time. Once documents are collected, data is exported directly to UltraTax, Lacerte, Drake, or CCH Axcess. Beyond tax season, Soraban can also support client intake throughout the accounting firm, making it a year-round solution for client intake and workflow management.

Implementing AI-powered organizers: From selection to ROI

Key features include:

- Adaptive questionnaires for both tax and non-tax work

- SOC 2 Type I compliance

- Mobile-first design with built-in messaging

- Automatic assembly of signature-ready files

- The ability for admins to send routine return packages without accountant review

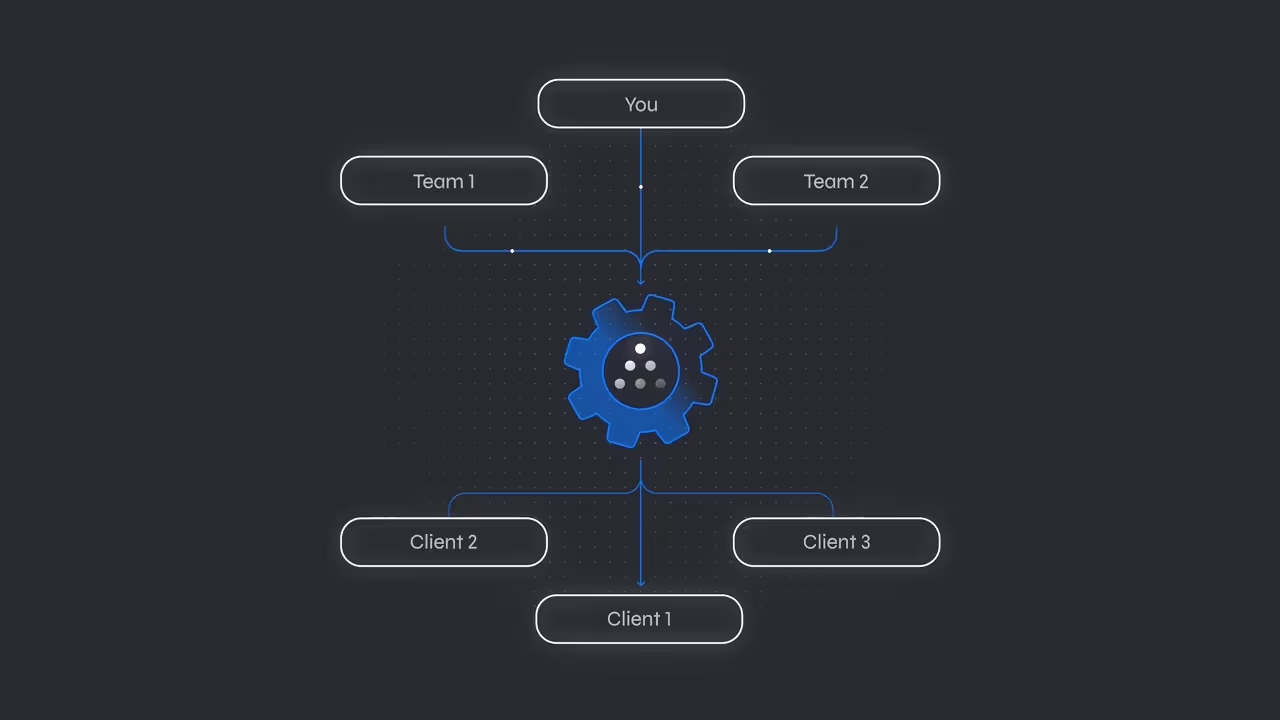

Measure success by tracking admin hours saved, capacity gains, data entry accuracy, and client satisfaction. Soraban manages the full intake-to-delivery process, using Collect to organize and validate documents, Connect to extract and map data, and Deliver to assemble, send, and track returns easily.

I’m not a fan of my current tax organizer, but clients still ask for it, so I send it out even though many clients don’t bother filling it out.

I don't want people to feel like they're having to do their own return.

Frequently asked questions:

1) What's the difference between a traditional organizer and an AI-powered one?

Traditional organizers are static PDFs filled manually, often requiring staff follow-ups. AI-powered organizers personalize questions using prior-year data, automatically recognize uploaded documents, and export information directly to tax software, reducing manual entry and streamlining workflows.

2) How much time will my firm actually save?

Time savings vary by firm, but many teams reclaim 30+ admin hours per month. Firms processing 250+ returns typically see faster ROI and can handle around 15% more returns with the same staff while improving accuracy and client experience.

3) Do clients need to download an app?

No app is required. Clients access white-labeled portals from any browser on a phone, tablet, or computer. Passwordless login and a mobile-first design simplify the experience, reduce confusion, and improve document submission rates.

4) What does "portal fatigue" mean?

Portal fatigue occurs when clients juggle multiple logins, portals, and passwords. AI-powered organizers address this by offering branded, passwordless access in a single, mobile-friendly portal, reducing frustration and keeping the document collection process smooth.

5) Which tax software integrates with these organizers?

Top platforms export directly to UltraTax CS, Lacerte, Drake, and CCH Axcess. This eliminates manual re-entry, reduces errors, and ensures client data flows effortlessly from intake to return preparation.

6) Are AI-powered organizers secure enough for tax data?

Look for SOC 2 Type I compliance, HTTPS encryption, multi-factor authentication, and full audit trails. These safeguards meet or exceed IRS requirements, keeping client documents and sensitive data secure at every step.

7) Can admin staff handle deliverables without accountant review?

Certain platforms allow admins to prepare and send complete return packages, collect e-signatures, and process payments for routine returns. This frees accountants for complex work while maintaining proper oversight and compliance.

8) How long does implementation take?

White-glove onboarding typically takes 30 days and includes admin training, data import, client setup, and workflow alignment. The best time to onboard is August through October or May through July — outside busy season — though year-round implementation is available if timing doesn't line up.

9) Do these organizers work beyond tax season?

Yes. Some platforms support year-round workflows such as bookkeeping, payroll, and advisory services. AI-powered intake adjusts to any service line, helping firms maintain client engagement and efficiency outside of seasonal tax work.

10) What size firm benefits most?

Firms processing 250+ returns annually typically see faster ROI and time savings. Smaller practices may still benefit, but it's important to evaluate whether the efficiency gains justify the investment for your specific volume and workflow.

Conclusion

Traditional client tax organizers often create more work than they solve. Chasing documents, renaming files, and manually matching uploads consumes hours your team can't afford. AI-powered organizers like Soraban handle these tasks, letting admins focus on managing workflows instead of monitoring inboxes.

Firms processing 500 to 2,000 returns and spending dozens of admin hours on intake see quick ROI. Start by evaluating what your current process costs; then, choose a platform that integrates with your tax software and fits your team's workflow.

Experience the difference for yourself — schedule a demo today to see Soraban in action.

See Our Solutions in Action